Introduction

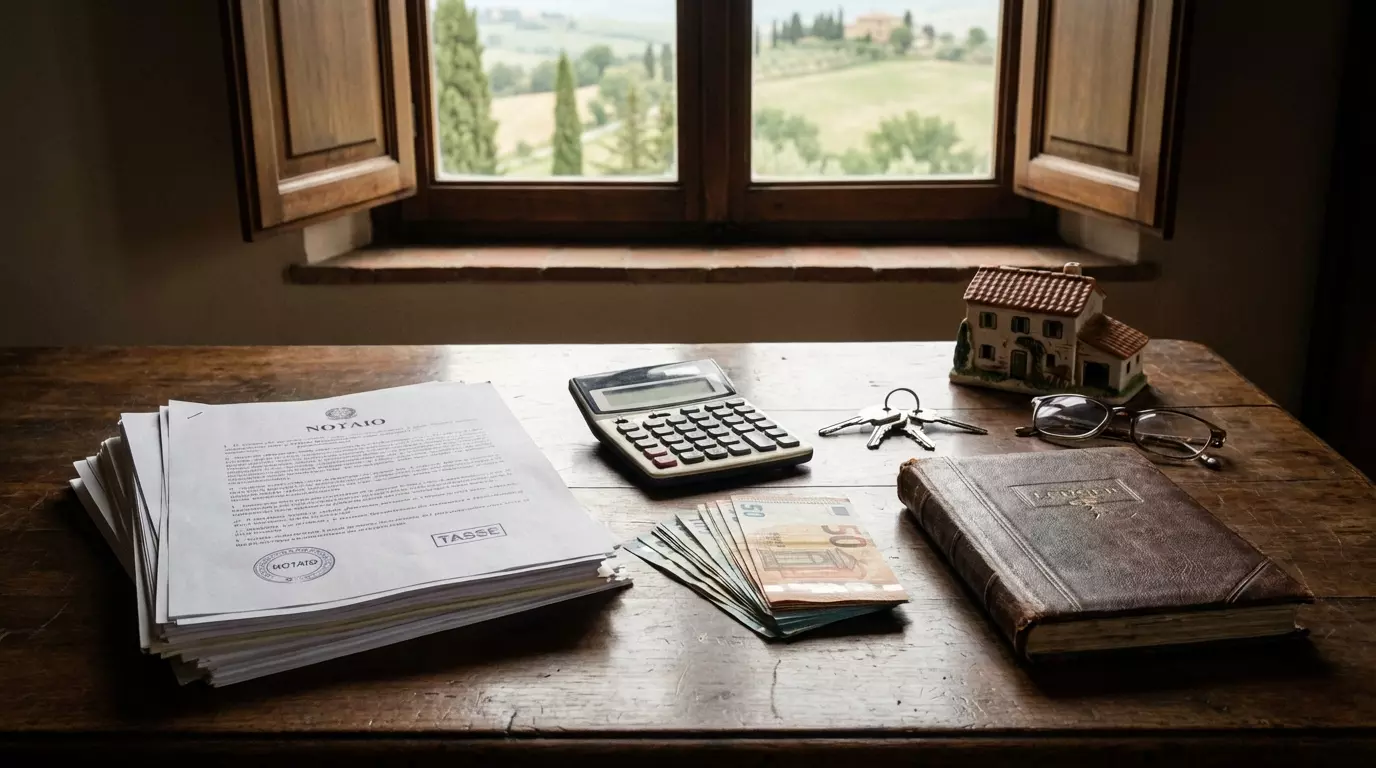

Buying property in Italy is a dream for many international investors and those seeking a slice of la dolce vita. However, understanding the true cost of purchasing Italian real estate goes far beyond the listing price. From government taxes to notary fees and unexpected regional variations, the additional expenses can add 10-15% to your total investment. This comprehensive guide breaks down every cost you’ll encounter when buying property in Italy in 2025, helping you budget accurately and avoid financial surprises. Whether you’re eyeing a Tuscan farmhouse or a Milan apartment, knowing these expenses upfront is essential for making informed decisions and ensuring your Italian property dream doesn’t turn into a financial nightmare.

Get 50% OFF!

Subscribe to our newsletter and enjoy a 50% discount on all listing packages, no strings attached!

The Italian property market has seen significant shifts in recent years, with varying costs across different regions and property types. Understanding the complete financial picture before making an offer is crucial for both first-time buyers and seasoned investors. This guide will walk you through the essential costs, from mandatory taxes to often-overlooked expenses that can catch unprepared buyers off guard.

Understanding Italy’s Property Purchase Taxes

The tax structure for property purchases in Italy varies significantly depending on whether you’re buying from a private seller or a company, and whether the property is classified as your primary residence (prima casa) or a secondary home. For resale properties purchased from private individuals, buyers acquiring their first home in Italy benefit from reduced rates: a 2% registration tax, along with fixed mortgage and cadastral taxes of €50 each. However, if the property serves as a second home, the registration tax jumps to 9%, making the tax burden considerably higher for investment properties or vacation homes.

When purchasing new construction or recently renovated properties from a construction company, the tax structure changes entirely. VAT (Value Added Tax) applies instead of registration tax. First-time homebuyers pay 4% VAT plus €200 each for registration and mortgage taxes. Second home buyers face 10% VAT (or 22% for luxury properties classified as A/1, A/8, or A/9 categories), plus the same fixed fees. These percentages are calculated on the cadastral value for resale properties, which is typically lower than the market price, or on the purchase price for new builds, making new construction potentially more expensive from a tax perspective.

Notary Fees and Legal Costs Explained

The notary (notaio) plays an indispensable role in Italian property transactions, acting as a public official who verifies the legality of the sale and registers the deed with land registries. Notary fees typically range between 1% and 2.5% of the property’s declared value, with the percentage decreasing as property values increase. For a €200,000 property, expect to pay approximately €2,000-€3,000 in notary fees, while a €500,000 property might incur €3,500-€5,000. These fees cover the notary’s professional services, including title searches, verification of property documentation, preparation of the deed of sale, and registration with the Land Registry.

Beyond the notary’s base fee, legal costs can accumulate quickly. While not legally required, many foreign buyers wisely engage an independent lawyer (avvocato) to review contracts and protect their interests, adding another 1-2% of the purchase price or €2,000-€4,000 in fees. The notary also collects taxes on behalf of the government and handles administrative costs like cadastral searches (€150-€300), land registry searches (€100-€200), and mortgage registration if you’re financing the purchase. According to real estate market data, these combined legal and administrative costs represent a significant portion of the total transaction expenses, making professional guidance valuable despite the added expense.

Hidden Expenses Most Buyers Overlook

Beyond taxes and legal fees, several hidden costs catch unprepared buyers by surprise. Real estate agent commissions in Italy typically range from 2% to 4% of the purchase price, and unlike some countries, both buyer and seller usually pay separate commissions. This means you could be paying €4,000-€8,000 on a €200,000 property just for agent services. Additionally, if you’re obtaining a mortgage, banks charge arrangement fees of 0.5% to 1% of the loan amount, plus valuation fees (€250-€500), and you’ll need to factor in currency exchange costs and potential losses if you’re converting from foreign currency.

Property surveys and technical inspections, while not mandatory, are highly recommended and often reveal issues that can save you from costly mistakes. A geometra (surveyor) charges €500-€1,500 for structural assessments, while specialized inspections for damp, electrical systems, or pest problems add €200-€500 each. Post-purchase costs also deserve consideration: IMU (municipal property tax) ranges from 0.4% to 1.06% annually depending on location and property type, though primary residences often receive exemptions. Buildings with shared facilities require condominium fees (€600-€3,000 annually), and utilities connection or transfer can cost €200-€500. Insurance premiums for buildings and contents add another €300-€800 yearly, while any immediate renovation needs could require substantial additional investment.

Regional Price Differences Across Italy

Italy’s property market shows dramatic regional variations in both purchase prices and associated costs. Northern cities like Milan and Venice command premium prices, with central Milan apartments averaging €5,000-€8,000 per square meter, while Venice’s historic center reaches €7,000-€10,000 per square meter. In these high-value markets, even with percentage-based fees remaining constant, the absolute costs are substantially higher. A €500,000 apartment in Milan will incur approximately €50,000-€75,000 in total additional costs, representing a significant capital requirement beyond the purchase price.

Central Italy, particularly Tuscany and Umbria, offers more moderate pricing while maintaining strong appeal for international buyers. Florence properties average €3,500-€5,000 per square meter, while rural Tuscan farmhouses range from €150,000 to €800,000 depending on size and condition. Southern regions and islands present the most affordable options, with Sicily and Puglia offering properties from €1,000-€2,500 per square meter. However, lower purchase prices don’t always translate to proportionally lower total costs, as some fixed fees remain constant regardless of property value, and rural properties may require more extensive surveys and renovation work. The €1 house schemes in depopulating southern villages attract headlines, but buyers must commit to renovations costing €20,000-€50,000 minimum, plus all standard transaction costs.

In Short

Purchasing property in Italy involves significantly more than the advertised price tag. Between purchase taxes, notary fees, legal costs, agent commissions, and various hidden expenses, buyers should budget an additional 10-15% of the property value for transaction costs alone. First-time homebuyers benefit from reduced tax rates, but even with these advantages, the costs remain substantial. Regional variations mean that while southern Italian properties offer lower purchase prices, the proportional impact of fixed fees can be greater, and potential renovation needs may offset initial savings.

Successful property purchase in Italy requires thorough financial planning, professional guidance, and realistic budgeting. Engaging qualified professionals including a notary, independent lawyer, and surveyor protects your investment and helps navigate Italy’s complex property laws. Understanding these costs upfront allows you to make informed decisions, negotiate effectively, and ensure your Italian property dream remains financially viable. Whether you’re buying a primary residence or investment property, accounting for all expenses from day one prevents unwelcome surprises and sets the foundation for a successful transaction.

FAQ Section

What are the main taxes when buying property in Italy?

The main taxes include registration tax (2% for first homes, 9% for second homes on resale properties) or VAT (4% for first homes, 10-22% for second homes on new builds), plus fixed mortgage and cadastral taxes of €50-€200 each. The tax structure depends on whether you’re buying from a private seller or construction company.

Do I need a lawyer when buying property in Italy?

While not legally mandatory, hiring an independent lawyer is highly recommended, especially for foreign buyers. Lawyers charge 1-2% of the purchase price but provide valuable protection by reviewing contracts, conducting due diligence, and ensuring your interests are protected throughout the transaction.

How much are notary fees in Italy?

Notary fees typically range from 1% to 2.5% of the property’s declared value, with the percentage decreasing for higher-value properties. For a €200,000 property, expect €2,000-€3,000, while a €500,000 property might incur €3,500-€5,000 in notary costs.

What is the total cost beyond the purchase price?

Total additional costs typically amount to 10-15% of the purchase price, including taxes, notary fees, legal costs, agent commissions, surveys, and various administrative expenses. On a €300,000 property, budget €30,000-€45,000 for these additional costs.

Are there ongoing costs after purchasing Italian property?

Yes, ongoing costs include IMU (municipal property tax) of 0.4-1.06% annually, condominium fees (€600-€3,000 yearly for apartments), utilities, insurance (€300-€800 annually), and maintenance. Primary residences often receive IMU exemptions.

Do property prices vary significantly across Italian regions?

Yes, regional variations are dramatic. Milan averages €5,000-€8,000 per square meter, Florence €3,500-€5,000, while southern regions like Sicily and Puglia offer properties at €1,000-€2,500 per square meter. However, lower prices don’t always mean proportionally lower total costs due to fixed fees.

Who pays real estate agent fees in Italy?

Unlike some countries, both buyer and seller typically pay separate agent commissions in Italy, each ranging from 2-4% of the purchase price. This means total agent fees can reach 4-8% of the property value, split between both parties.

What is cadastral value and why does it matter?

Cadastral value is the official registered value of a property, typically lower than market price. For resale properties, taxes are calculated on this cadastral value rather than the actual purchase price, potentially reducing your tax burden significantly compared to the market value.

Join The Discussion