The European housing market is experiencing its most dramatic transformation in over a decade as the European Central Bank’s aggressive monetary policy stance continues to reshape the real estate landscape throughout 2025. Rising interest rates, which have climbed to levels not seen since the early 2000s, are creating ripple effects across major metropolitan areas from Amsterdam to Athens, fundamentally altering buyer behavior and market dynamics.

Get 50% OFF!

Subscribe to our newsletter and enjoy a 50% discount on all listing packages, no strings attached!

This comprehensive analysis examines the current state of Europe’s housing market, exploring how elevated borrowing costs are impacting everything from luxury penthouses in Paris to starter homes in Prague. The data reveals a market in transition, where traditional patterns of growth and investment are being rewritten by economic realities that favor neither buyers nor sellers in the short term.

ECB Rates Hit 4.5% Triggering Market Shift

The European Central Bank’s decision to maintain interest rates at 4.5% throughout 2025 has created a seismic shift in housing market fundamentals across the eurozone. This represents the highest rate environment since 2008, with the central bank citing persistent inflationary pressures and the need to cool overheated property markets in several member states. The rate increases, which began in earnest in late 2022, have now reached a level that significantly impacts mortgage affordability calculations for millions of potential homebuyers.

Market analysts are observing unprecedented changes in transaction volumes and pricing strategies as both buyers and sellers adjust to the new reality. The higher rates have effectively priced out approximately 30% of potential buyers who were active in the market just 18 months ago, according to recent data from major European mortgage lenders. This dramatic reduction in buyer pool has forced sellers to reconsider pricing expectations, leading to the first sustained period of price corrections in many markets since the 2008 financial crisis.

Home Prices Drop 12% Across Major EU Cities

Property values across Europe’s major metropolitan areas have declined by an average of 12% compared to their 2024 peaks, with some cities experiencing even steeper corrections. Dublin leads the decline with a 18% drop in median home prices, followed closely by Stockholm at 16% and Amsterdam at 15%. Even traditionally stable markets like Vienna and Munich have seen corrections of 8% and 10% respectively, signaling that the impact of higher borrowing costs is being felt universally across different market segments.

The price corrections are most pronounced in the premium segment, where homes above €1 million have seen average declines of 15-20% in major cities. Berlin’s luxury market has been particularly affected, with properties in prime districts like Mitte and Charlottenburg experiencing price reductions of up to 22%. Meanwhile, more affordable housing segments have shown greater resilience, with starter homes and apartments under €300,000 seeing more modest declines of 6-8% on average. This divergence suggests that rate sensitivity increases significantly with property value, as higher-priced homes require larger mortgages that are more dramatically affected by interest rate changes.

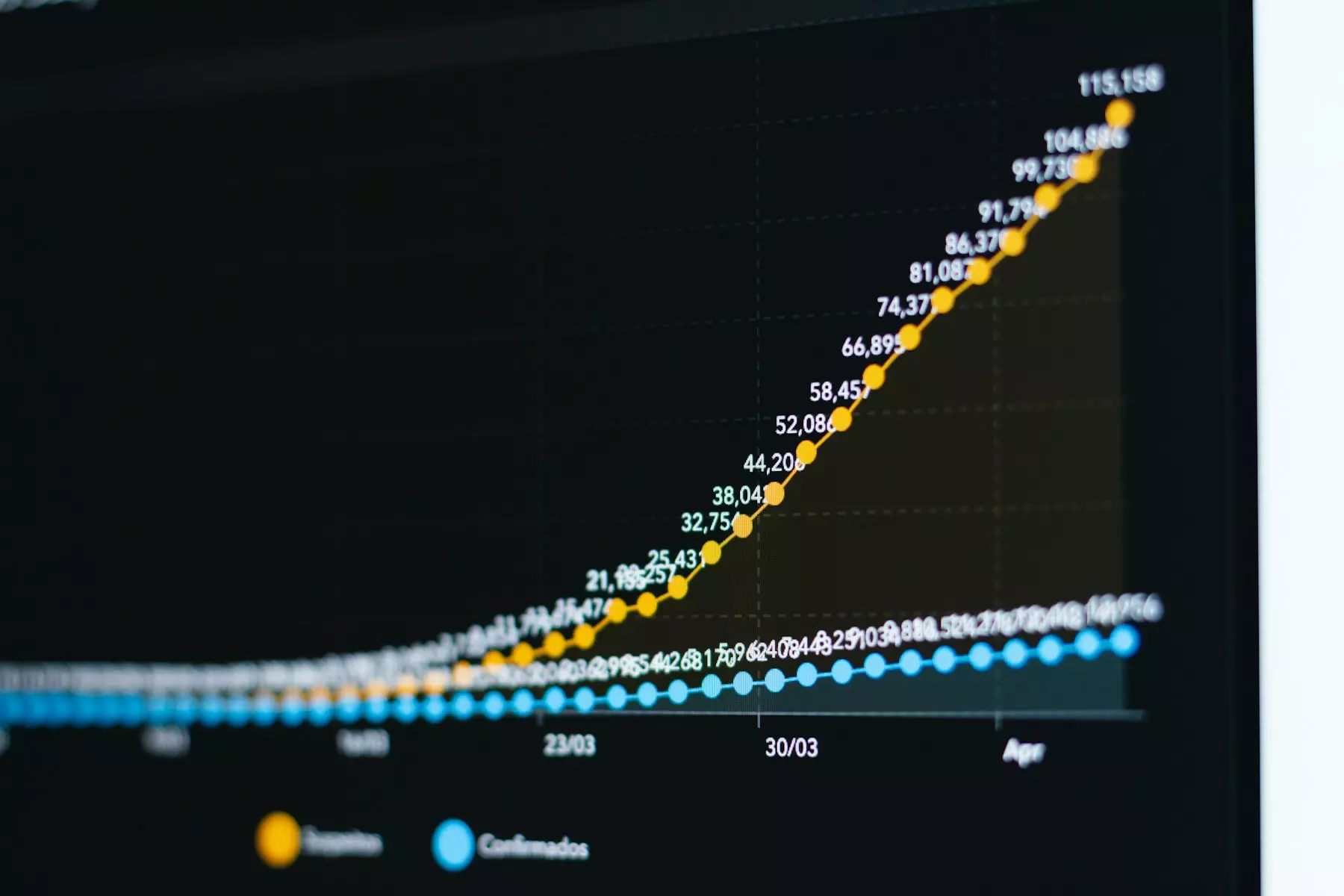

Mortgage Demand Falls 35% in Q3 2025 Data

The latest quarterly data reveals a stark 35% decline in mortgage applications across the European Union during Q3 2025, compared to the same period in the previous year. This dramatic reduction in lending activity reflects the combined impact of higher rates and tightened lending standards implemented by banks responding to increased regulatory scrutiny. Major lenders report that the average mortgage rate for a 30-year fixed loan has climbed to 6.2%, compared to 2.8% in early 2022, effectively doubling monthly payment obligations for new borrowers.

Regional variations in mortgage demand show interesting patterns, with Nordic countries experiencing the steepest declines at 42%, while Southern European markets have seen more moderate reductions of 28%. France and Germany, representing the largest mortgage markets in the EU, have recorded declines of 33% and 37% respectively. The data also reveals a shift toward shorter-term loan products, with 15-year mortgages gaining popularity as borrowers seek to minimize interest exposure, despite the higher monthly payments. Banks are reporting that loan-to-value ratios have tightened significantly, with many institutions now requiring minimum down payments of 25-30% compared to the 10-15% that was common during the low-rate environment.

First Time Buyers Face New Affordability Crisis

The combination of elevated interest rates and persistent high property values has created an unprecedented affordability crisis for first-time homebuyers across Europe. Analysis of income-to-mortgage payment ratios shows that the typical first-time buyer now needs to allocate 45% of gross household income to mortgage payments, well above the traditional 30% threshold considered sustainable by financial advisors. In expensive markets like London, Paris, and Zurich, this ratio can exceed 60% for median-income households attempting to purchase starter properties.

Government response to the affordability crisis has been mixed, with several countries implementing or expanding first-time buyer assistance programs. The Netherlands has increased its mortgage guarantee scheme coverage to 105% of property value for first-time buyers, while Ireland has extended its Help to Buy program through 2026 with enhanced benefits. However, these measures are struggling to offset the fundamental mathematics of higher borrowing costs. Industry data suggests that the average age of first-time buyers has increased by 2.5 years since 2022, now reaching 34 years old, as younger households find themselves unable to qualify for mortgages or accumulate sufficient down payments in the current environment.

Investment Properties See 28% Transaction Decline

The buy-to-let and investment property sector has experienced a particularly sharp contraction, with transaction volumes falling 28% year-over-year as of Q3 2025. Higher mortgage rates have compressed rental yields to levels that many investors consider unacceptable, with gross yields in major cities now averaging 4.2% compared to borrowing costs exceeding 6%. This negative leverage situation has prompted many property investors to either postpone purchases or liquidate existing portfolios, contributing to increased inventory in several markets.

Institutional investors and property funds are also reassessing their European real estate strategies in light of the changed economic environment. Several major REITs have announced reduced acquisition targets for 2025, with some pivoting toward development projects that can benefit from the eventual normalization of interest rates. The data shows that cash purchases now represent 38% of investment property transactions, up from 22% in 2022, as investors with available capital gain significant negotiating advantages over leveraged competitors. This shift toward cash transactions is helping to stabilize some market segments while creating a two-tier system where access to financing increasingly determines market participation.

The European housing market’s response to sustained higher interest rates is creating a new paradigm that will likely persist well beyond 2025. While current conditions present significant challenges for both buyers and sellers, they also represent a necessary correction that addresses years of unsustainable price growth fueled by ultra-low borrowing costs. The market is gradually finding new equilibrium points that reflect the reality of normalized interest rates and more conservative lending practices.

Looking ahead, the key factors to monitor will be the ECB’s monetary policy trajectory, employment trends, and government policy responses to housing affordability concerns. While the immediate outlook remains challenging, these market adjustments are laying the groundwork for a more sustainable and balanced European housing market that better serves the long-term needs of both homeowners and investors. The transformation currently underway will ultimately create opportunities for those positioned to navigate the new landscape effectively.

Join The Discussion