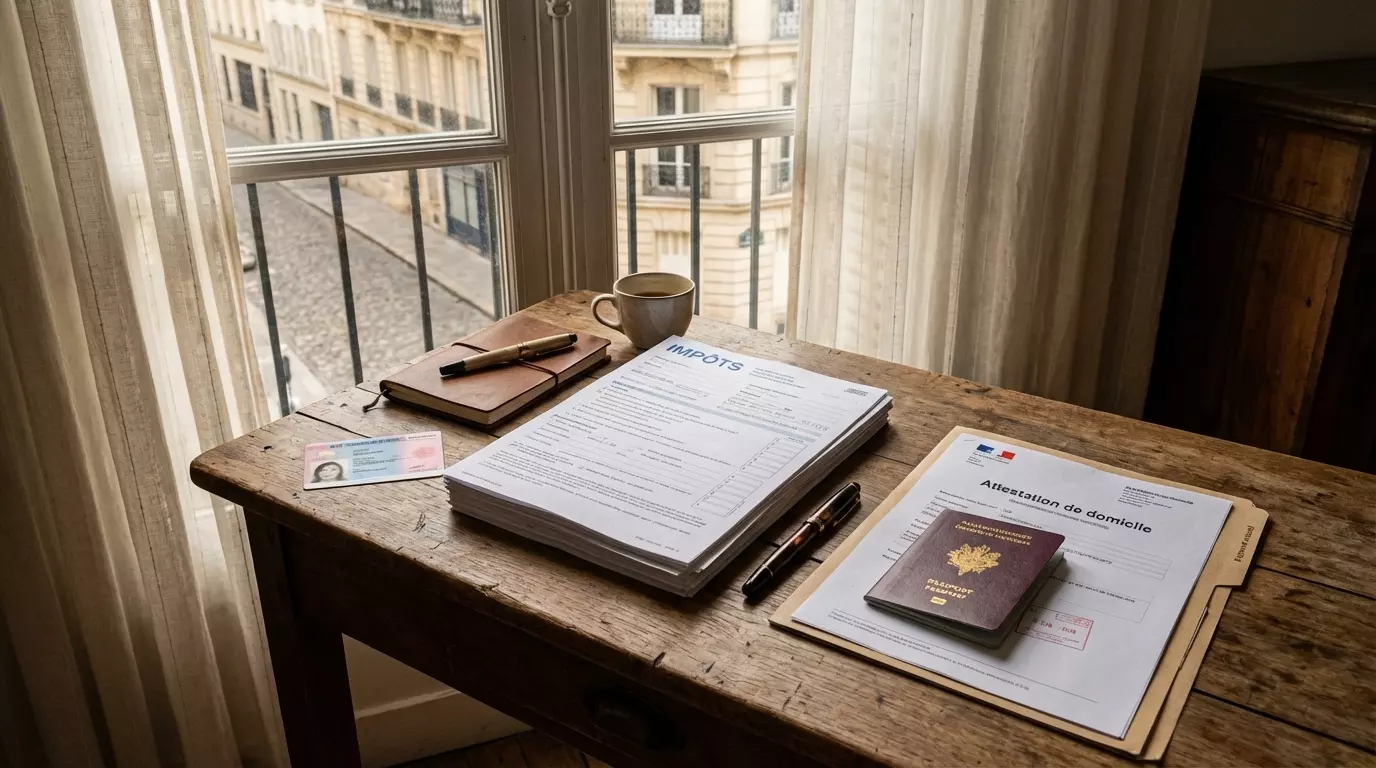

Moving to France represents an exciting life change, but it comes with a substantial amount of legal paperwork and administrative requirements that can feel overwhelming. Whether you’re relocating for work, retirement, or simply seeking a new adventure in the French countryside, understanding the legal framework is essential for a smooth transition. The French administrative system has its own unique procedures and timelines that differ significantly from other countries, making proper preparation crucial.

Get 50% OFF!

Subscribe to our newsletter and enjoy a 50% discount on all listing packages, no strings attached!

This comprehensive guide walks you through the essential legal steps you need to take when moving to France. From securing the right visa to registering with local authorities, setting up healthcare coverage, and managing your tax obligations, we’ll cover everything you need to know. By following this legal checklist, you’ll be better prepared to navigate the French bureaucracy and settle into your new life with confidence.

Understanding Your Visa and Residency Requirements

Before packing your bags, determining which visa or residency permit you need is the most critical first step. Your nationality, reason for moving, and intended length of stay will dictate which type of visa you must apply for. EU and EEA citizens enjoy freedom of movement and don’t require a visa to live in France, though they still need to register if staying longer than three months. For British citizens post-Brexit, the rules have changed significantly, and they now need to follow similar procedures to other non-EU nationals.

Non-EU citizens typically need to apply for a long-stay visa (visa de long séjour) from their home country before arriving in France. Common visa types include work visas, student visas, visitor visas for retirees, and family reunion visas. Each category has specific requirements, documentation needs, and processing times that can range from several weeks to months. It’s advisable to start your visa application at least three to four months before your planned move date. The France Visas official portal provides detailed information about which visa category applies to your situation and the required supporting documents.

Registering with French Authorities After Arrival

Once you arrive in France with your long-stay visa, you must validate it within three months of arrival. This process involves registering with the French Office for Immigration and Integration (OFII) if your visa requires it. You’ll receive instructions with your visa about whether OFII registration is mandatory for your visa type. The validation process typically includes a medical examination and an interview about your integration into French society.

Beyond visa validation, you’ll need to register with your local town hall (mairie) to establish your residency. While this isn’t always legally mandatory for everyone, it’s highly recommended as it helps you access local services and proves your address for various administrative procedures. You should also apply for a residence permit (titre de séjour) if required for your visa category. The application must be submitted to your local prefecture within two months before your long-stay visa expires. Gathering all necessary documents beforehand, including proof of address, passport photos, financial statements, and your validated visa, will streamline this process considerably.

Setting Up Healthcare and Social Security Coverage

France boasts one of the world’s best healthcare systems, and accessing it properly is essential for your wellbeing and legal compliance. If you’re moving to France for work, your employer will typically register you with the French social security system (Sécurité Sociale), which provides comprehensive health coverage. You’ll receive a social security number (numéro de sécurité sociale) and a Carte Vitale, the green card that serves as your health insurance card and is essential for reimbursements.

For those not employed, such as retirees or students, the process differs slightly. Since 2016, France has implemented the Protection Universelle Maladie (PUMA), which provides health coverage to anyone legally residing in France on a stable and regular basis for more than three consecutive months. You’ll need to register with your local primary health insurance fund (CPAM) by providing proof of residence, identity documents, and evidence of your legal right to stay in France. According to Ameli, the official health insurance website, processing times can take several weeks, so it’s wise to maintain private health insurance during your initial months in France. Many expats also choose to supplement their state coverage with top-up insurance (mutuelle) to cover expenses not fully reimbursed by the basic system.

Managing Your Finances and Tax Obligations

Understanding French tax residency rules is crucial because France taxes its residents on their worldwide income. You’re generally considered a French tax resident if France is your primary home, your main place of work, or the center of your economic interests. Tax residency can begin from your first day in France if you meet these criteria, so it’s not simply about spending 183 days in the country, though that’s also a determining factor.

Opening a French bank account should be a priority as it’s required for many administrative procedures, including receiving salaries, paying rent, and setting up direct debits for utilities. French banks typically require proof of identity, proof of address in France, and sometimes proof of income or employment. Some banks are more expat-friendly than others, so research your options beforehand. Regarding taxes, you’ll need to register with the tax office (centre des impôts) and obtain a tax number (numéro fiscal). France operates a pay-as-you-earn tax system called “prélèvement à la source” where income tax is deducted directly from salaries. However, you’ll still need to file an annual tax return, usually due in May or June for the previous year’s income. If you have assets or income in other countries, understanding double taxation treaties between France and your home country is essential to avoid being taxed twice on the same income. The French tax authority website offers resources in multiple languages to help you navigate these obligations.

Additional Legal Considerations

Beyond the main requirements, several other legal matters deserve attention when relocating to France. If you’re bringing a vehicle from another country, you have six months to register it with French authorities and obtain French license plates. This process involves obtaining a certificate of conformity, passing a technical inspection, and paying registration fees. Similarly, if you hold a non-EU driving license, you may need to exchange it for a French license within your first year of residency, depending on reciprocal agreements between France and your home country.

Property matters also require careful attention. If you’re renting, French tenancy law strongly favors tenants, but you’ll need to understand your rights and obligations under your lease agreement. Landlords typically require numerous documents including proof of income, employment contracts, and sometimes a French guarantor. If you’re purchasing property, engaging a bilingual notaire (notary) is essential as they handle all legal aspects of property transactions in France. Don’t forget about practical matters like registering children for school, transferring or obtaining new insurance policies for home and car, and understanding your rights as a consumer under French law.

Frequently Asked Questions

How long does it take to get a French residence permit?

Processing times vary by prefecture and visa type, but typically range from two to four months. Some prefectures are experiencing significant delays, so apply well before your long-stay visa expires. You’ll receive a receipt (récépissé) that allows you to remain legally in France while your application is processed.

Do I need to speak French to complete these administrative procedures?

While not legally required, speaking French significantly eases the process. Many prefecture staff and local officials don’t speak English. Consider hiring a bilingual immigration consultant or bringing a French-speaking friend to important appointments if your language skills are limited.

Can I work in France while waiting for my residence permit?

This depends on your visa type and the receipt you receive when applying for your residence permit. Some receipts explicitly authorize work, while others don’t. Check your receipt carefully or ask the prefecture staff when submitting your application.

What happens if I don’t register with French authorities on time?

Missing deadlines can result in fines, difficulty renewing your residence permit, or in serious cases, deportation. If you’ve missed a deadline, contact the relevant authority immediately to explain your situation and seek guidance on rectifying it.

Do I need private health insurance in addition to French social security?

While not mandatory, most French residents purchase complementary insurance (mutuelle) because the state system doesn’t cover 100% of all medical costs. Dental care, optical services, and certain medications particularly benefit from additional coverage.

In Short

Relocating to France requires careful navigation of various legal and administrative requirements, but proper preparation makes the process manageable. Starting with securing the appropriate visa for your situation, you’ll then need to register with French authorities, establish healthcare coverage, and organize your financial and tax affairs. Each step has specific timelines and documentation requirements that must be followed to ensure legal compliance.

The key to a successful move is starting early, staying organized, and being patient with the French administrative system. While the bureaucracy can seem daunting, thousands of people successfully relocate to France each year by following these procedures systematically. Consider seeking professional advice from immigration lawyers or relocation specialists if your situation is complex, and don’t hesitate to ask questions at each stage of the process. With proper planning and attention to these legal requirements, you’ll be well-positioned to enjoy everything that life in France has to offer.

Join The Discussion