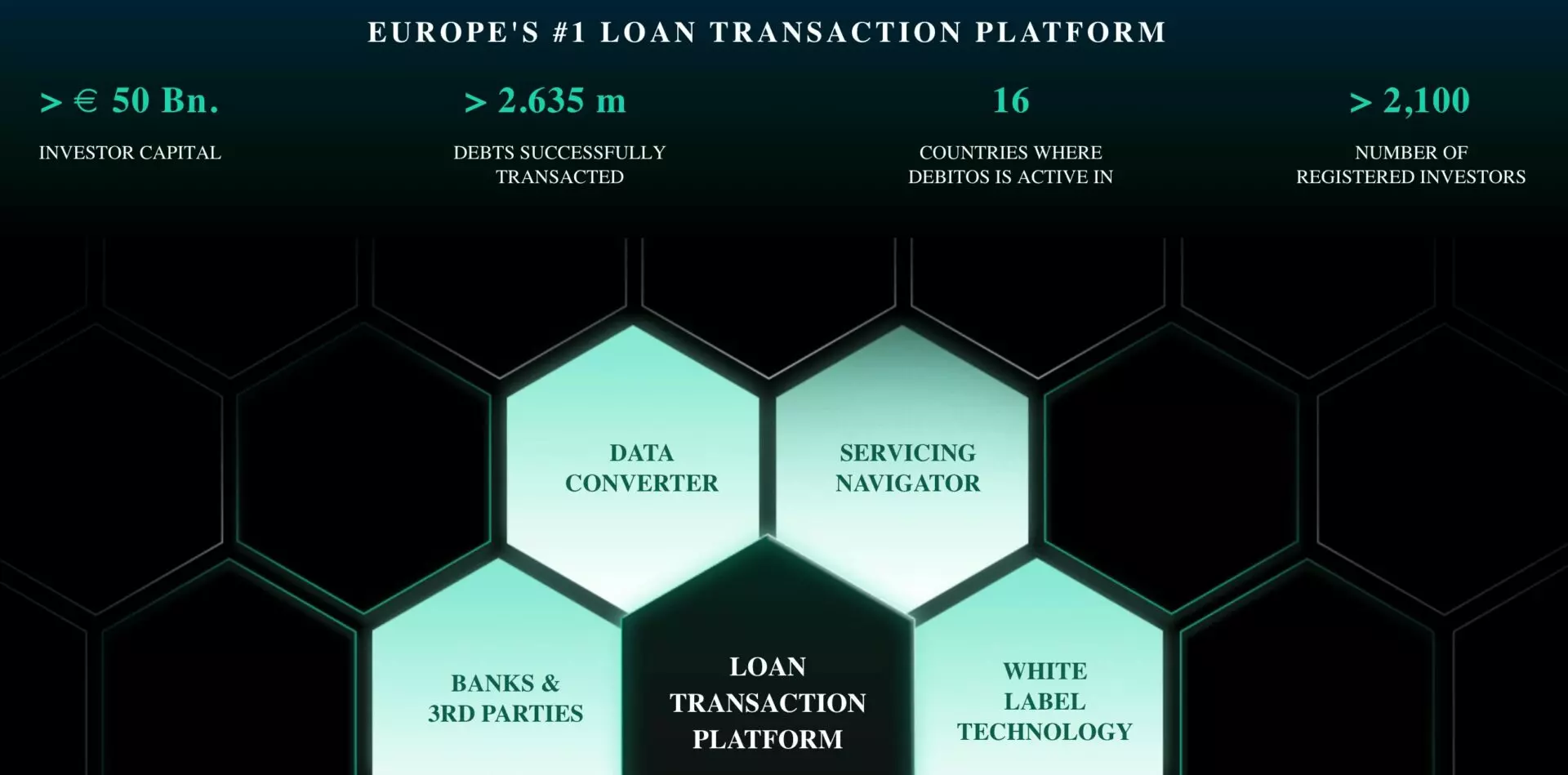

The European real estate landscape continues to evolve at a rapid pace, driven by innovative investment strategies, shifting market dynamics, and a renewed focus on cross-border opportunities. Recent developments highlight Debitos, a prominent player in the sector, as it accelerates its expansion across Europe through strategic transactions in Italy and Greece. These moves not only underscore Debitos’ commitment to strengthening its regional presence but also reflect broader trends shaping the continent’s real estate investment climate.

Get 50% OFF!

Subscribe to our newsletter and enjoy a 50% discount on all listing packages, no strings attached!

Analyzing Debitos’ Strategic Expansion: Key Insights and Market Implications

Debitos’ recent foray into Italy and Greece exemplifies a calculated approach to capturing emerging opportunities within the European real estate sector. Following its successful market entry in other regions, the company has identified Italy and Greece as pivotal markets for growth, driven by their unique economic trajectories, demographic shifts, and evolving investment landscapes.

One of the most notable aspects of Debitos’ strategy is its focus on leveraging local market nuances while maintaining a pan-European outlook. In Italy, the emphasis appears to be on revitalizing urban centers and capitalizing on the country’s rich architectural heritage, combined with the increasing demand for mixed-use developments. Greece, on the other hand, presents a compelling case with its post-crisis recovery, burgeoning tourism sector, and attractive property prices, making it an appealing destination for both domestic and international investors.

Emerging Trends in European Real Estate: What Debitos’ Moves Reveal

Several overarching trends are evident from Debitos’ recent transactions, which serve as a microcosm of broader market shifts:

- Resurgence of Southern European Markets: Countries like Italy and Greece are experiencing a renaissance, driven by political stability, economic reforms, and increased foreign investment. This resurgence is attracting players like Debitos seeking to diversify portfolios and tap into high-growth potential.

- Focus on Sustainable and Adaptive Reuse Projects: Investors are increasingly prioritizing environmentally sustainable developments and adaptive reuse of existing structures, aligning with European Union directives on green building standards.

- Digital Transformation and Data-Driven Investment: The integration of advanced analytics, AI, and digital platforms is transforming how deals are sourced, evaluated, and executed, enabling more precise risk assessment and portfolio optimization.

Implications for Investors and Market Participants

Debitos’ strategic transactions signal a shift towards more dynamic and opportunistic investment behaviors across Europe. For investors, this underscores the importance of adopting a flexible, data-informed approach to identify emerging markets and asset classes. The Italian and Greek markets, in particular, offer compelling opportunities for those willing to navigate local regulatory environments and cultural nuances.

Moreover, the focus on sustainable development aligns with European policy frameworks and investor preferences, emphasizing long-term value creation over short-term gains. As Debitos continues to expand its footprint, market participants should consider how these trends influence their own investment strategies and asset management practices.

Case Studies: Successful Transactions and Market Entry Strategies

While specific transaction details are proprietary, industry analysts note that Debitos’ approach involves meticulous due diligence, local partnerships, and a keen understanding of market cycles. For instance, in Italy, the company has targeted distressed assets in major urban hubs, aiming to reposition them for high-demand uses such as residential or commercial spaces. In Greece, investments have focused on hospitality and tourism-related properties, capitalizing on the country’s post-pandemic recovery trajectory.

This strategic focus on asset repositioning and market-specific opportunities exemplifies a sophisticated understanding of regional dynamics, setting a benchmark for other European investors.

Looking Ahead: The Future of European Real Estate Investment

The European real estate sector is poised for continued transformation, driven by technological innovation, policy shifts, and changing investor priorities. Debitos’ recent expansion into Italy and Greece exemplifies a broader trend of diversification and strategic positioning within emerging markets.

As the continent navigates economic uncertainties and geopolitical shifts, resilient and adaptable investment strategies will be paramount. The integration of sustainable practices, digital tools, and local expertise will define successful market entries and portfolio growth in the coming years.

Conclusion: Embrace the Opportunities in Europe’s Evolving Real Estate Landscape

Debitos’ strategic transactions in Italy and Greece highlight the immense potential within Europe’s diverse real estate markets. For investors, developers, and market analysts, these moves serve as a clarion call to explore emerging opportunities, leverage innovative technologies, and adopt a nuanced understanding of regional dynamics.

Join The Discussion