Navigating the Dutch Property Market: Your Complete Guide to Buying a Home in 2026

The Dutch housing market has long been a challenging landscape for international buyers, but 2026 brings new opportunities and considerations for expats looking to purchase their dream home in the Netherlands. Understanding the intricacies of this unique market has never been more important, especially as property prices continue to evolve and mortgage regulations adapt to changing economic conditions. IamExpat recently hosted an insightful webinar designed to help prospective homebuyers navigate this complex process without the overwhelming stress that often accompanies such a significant financial decision.

Get 50% OFF!

Subscribe to our newsletter and enjoy a 50% discount on all listing packages, no strings attached!

Whether you’re a first-time buyer or someone looking to upgrade your living situation, the Dutch property market presents both exciting opportunities and notable challenges. This comprehensive guide draws from expert insights to help you understand what it takes to successfully purchase a home in the Netherlands in 2026, from securing financing to closing the deal on your perfect property.

Understanding the Dutch Housing Market in 2026

The Dutch housing market in 2026 continues to be characterized by high demand and limited supply, particularly in major urban centers like Amsterdam, Rotterdam, Utrecht, and The Hague. According to recent CBS statistics, property prices have shown resilience despite economic fluctuations, making it crucial for buyers to enter the market well-prepared and informed. The current landscape requires prospective homeowners to act quickly when opportunities arise, while simultaneously conducting thorough due diligence to ensure they’re making sound investment decisions.

Understanding market trends is essential for timing your purchase correctly. The Dutch housing market operates differently from many other countries, with unique features such as the National Mortgage Guarantee (Nationale Hypotheek Garantie) and specific energy efficiency requirements that can significantly impact property values. International buyers should familiarize themselves with neighborhood dynamics, commuting patterns, and long-term development plans that might affect property appreciation. Additionally, factors like proximity to international schools, public transportation accessibility, and local amenities play crucial roles in determining both immediate livability and future resale potential.

Essential Steps to Secure Your Mortgage

Securing a mortgage in the Netherlands as an expat requires careful preparation and understanding of local banking requirements. Dutch lenders typically allow borrowers to finance up to 100% of the property’s value, though this depends on various factors including your income, employment contract, and credit history. The first critical step involves obtaining a preliminary mortgage approval, which demonstrates to sellers that you’re a serious buyer with actual purchasing power. Most financial advisors recommend starting this process at least three to six months before you begin actively house hunting.

Working with a specialized mortgage advisor who understands the unique circumstances of international buyers can make a tremendous difference in your success rate. These professionals can help you navigate the complexities of Dutch tax regulations, including the mortgage interest deduction (hypotheekrenteaftrek), which allows homeowners to deduct mortgage interest from their taxable income. You’ll need to gather extensive documentation including:

- Valid residence permit or proof of EU citizenship

- Employment contract (preferably permanent or with sufficient remaining duration)

- Recent salary slips and annual tax statements

- Bank statements from the past three months

- Proof of any additional income sources

- Overview of existing debts and financial obligations

Additionally, understanding your borrowing capacity is fundamental to setting realistic expectations. Dutch lenders calculate maximum loan amounts based on your gross annual income, using standardized calculation methods that factor in your age, interest rates, and repayment terms. The National Institute for Family Finance Information provides detailed calculators that can help you estimate your borrowing power before approaching lenders.

Navigating Viewings and Making an Offer

Once your financing is in order, the exciting phase of viewing properties begins. The Dutch property market moves quickly, with desirable homes often receiving multiple offers within days of listing. Successful buyers attend viewings prepared with a clear checklist of must-haves and deal-breakers, understanding that compromise is often necessary in competitive markets. During viewings, pay close attention to structural elements, energy efficiency ratings (which are mandatory in the Netherlands), and any signs of maintenance issues that could translate into significant expenses down the line.

Making a competitive offer requires strategic thinking and market awareness. In the Netherlands, it’s common practice to make an offer through your real estate agent (makelaar), who will communicate with the seller’s agent on your behalf. Your initial offer typically includes several conditions, known as “voorbehouden,” which protect your interests. The most common conditions include:

- Financing reservation (financieringsvoorbehoud): contingent on securing mortgage approval

- Structural inspection clause (bouwkundig keuringsvoorbehoud): allowing for professional property inspection

- Association of Owners documents review (VvE-stukken): for apartment purchases

- Cooling-off period (bedenktijd): typically three days for buyers to reconsider

Understanding local market dynamics helps you gauge how aggressive your offer needs to be. In highly competitive areas, properties often sell above asking price, sometimes requiring buyers to waive certain conditions to make their offers more attractive. However, rushing into decisions without proper inspections or financial safeguards can lead to costly mistakes.

Completing the Purchase: Legal Requirements

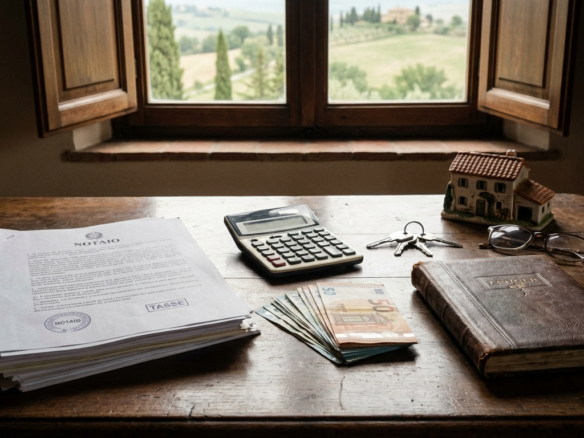

The final stages of purchasing a Dutch property involve several legal steps that must be completed through a civil law notary (notaris). Unlike in some countries where buyers and sellers have separate legal representation, in the Netherlands, a single notary handles the transaction for both parties, ensuring all legal requirements are met. The notary conducts title searches, prepares the deed of transfer (leveringsakte), and registers the property transfer with the Dutch Land Registry (Kadaster). This process typically takes six to eight weeks from the moment your offer is accepted.

Before the final signing, you’ll need to arrange several important matters. Property insurance must be in place before the transfer date, protecting your investment from the moment you become the legal owner. You’ll also need to budget for closing costs, which in the Netherlands typically amount to 2-5% of the purchase price. These costs include:

- Notary fees (approximately €1,000-€2,000)

- Transfer tax (2% for primary residences, higher for investment properties)

- Mortgage deed costs (roughly €500-€1,000)

- Real estate agent fees (if you hired a buying agent)

- Property valuation report (required by lenders)

- Building inspection costs (if conducted)

The actual transfer takes place at the notary’s office, where you’ll sign the final documents and receive the keys to your new home. The notary will transfer the purchase funds from your mortgage lender and any personal contributions to the seller’s account, completing the transaction. After signing, the notary registers the property in your name with the Kadaster, and you officially become a Dutch homeowner. According to government regulations, all property transfers must be registered within specific timeframes to ensure legal validity.

In Short

Purchasing a home in the Netherlands in 2026 doesn’t have to be an overwhelming experience when you approach it with proper preparation and expert guidance. By understanding the unique characteristics of the Dutch housing market, securing your financing early, strategically navigating viewings and offers, and carefully completing all legal requirements, you can successfully transition from renter to homeowner. The key lies in starting early, seeking professional advice from mortgage advisors and real estate agents who specialize in working with international buyers, and remaining patient yet decisive when the right opportunity presents itself.

The investment you make in educating yourself about the Dutch property market will pay dividends throughout the purchasing process and beyond. Remember that buying a home is not just a financial transaction but a significant life decision that will impact your daily experience of living in the Netherlands. Take advantage of resources like the IamExpat webinar and other educational opportunities to build your knowledge base, and don’t hesitate to ask questions throughout the journey. With the right preparation and mindset, you’ll be unlocking the door to your Dutch home before you know it.

Frequently Asked Questions

How much deposit do I need to buy a house in the Netherlands in 2026?

While Dutch lenders can theoretically finance up to 100% of the property value, most buyers should expect to provide some personal contribution. This is particularly true for expats, who may face slightly stricter requirements. Having 5-10% of the purchase price available demonstrates financial stability and can improve your mortgage terms.

Can I buy property in the Netherlands if I’m not a Dutch citizen?

Yes, foreigners can purchase property in the Netherlands without restrictions. However, securing a mortgage as a non-resident or someone without a permanent contract can be more challenging. Having a valid residence permit and stable employment significantly improves your chances of mortgage approval.

How long does the entire home buying process take in the Netherlands?

From starting your mortgage application to receiving the keys, the process typically takes three to six months. This includes time for mortgage approval (4-6 weeks), house hunting (variable), and the legal transfer process (6-8 weeks after offer acceptance). In competitive markets, some buyers spend longer finding the right property.

What are the ongoing costs of homeownership in the Netherlands?

Beyond your mortgage payments, budget for property tax (onroerendezaakbelasting), water board charges (waterschapsbelasting), home insurance, maintenance costs, and energy bills. For apartments, monthly VvE (homeowners association) contributions cover building maintenance and shared facilities. These costs typically amount to 1-2% of the property value annually.

Should I hire a buying agent (aankoopmakelaar)?

While not mandatory, hiring a buying agent can be extremely valuable, especially for expats unfamiliar with the Dutch market. They provide market insights, accompany you to viewings, advise on offer strategies, and handle negotiations. Their fees (typically 1-2% of purchase price) are often recovered through better purchase prices and avoided mistakes.

What is the National Mortgage Guarantee and do I need it?

The National Mortgage Guarantee (NHG) is a government-backed guarantee that protects both lenders and borrowers in case of financial difficulties. It’s available for properties up to €435,000 (2026 limit) and typically results in lower interest rates. While not mandatory, it’s highly recommended for eligible buyers as it provides significant financial security.

Join The Discussion