Spain’s Housing Market: A Cautionary Tale

Spain’s Housing Market: A Cautionary Tale

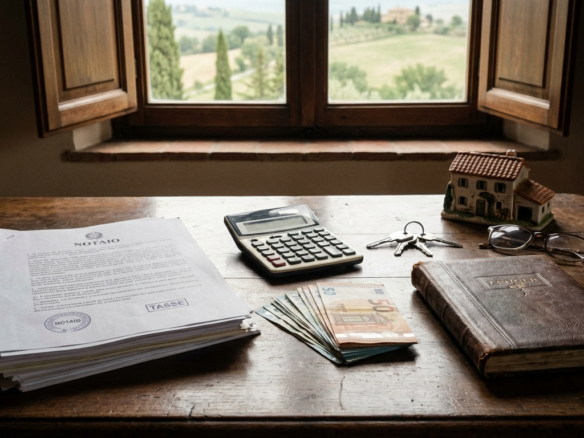

Spain’s housing crisis has become a textbook example of how well-intentioned government policies can create the exact opposite of their intended effects. Over the past few years, Spanish cities have witnessed rental prices skyrocket to unprecedented levels, leaving thousands of residents struggling to find affordable accommodation. The irony lies in the fact that these price increases have accelerated precisely after the government implemented strict rent control measures designed to make housing more accessible to ordinary citizens.

Get 50% OFF!

Subscribe to our newsletter and enjoy a 50% discount on all listing packages, no strings attached!

The situation in Spain mirrors similar housing crises across Europe and other parts of the world where governments have attempted to solve affordability issues through price controls and heavy regulation. What makes the Spanish case particularly instructive is how quickly the negative consequences materialized and how clearly they demonstrate fundamental economic principles that politicians often choose to ignore. Understanding what went wrong in Spain provides valuable lessons for policymakers worldwide who are grappling with their own housing affordability challenges.

When Government Intervention Backfires Badly

The Spanish government’s approach to the housing crisis centered on implementing strict rent control policies, particularly in major cities like Barcelona and Madrid. These regulations capped the amount landlords could charge for rent and imposed severe restrictions on rental increases. Politicians promoted these measures as necessary protections for tenants against greedy landlords, promising that price controls would finally make housing affordable for working families and young people struggling to enter the rental market.

However, the results proved disastrous. Rather than increasing housing availability and lowering costs, the regulations triggered a massive withdrawal of rental properties from the market. Landlords, faced with diminishing returns and increased regulatory burdens, chose to sell their properties, convert them to short-term vacation rentals, or simply leave them vacant rather than deal with the restrictive rental framework. The predictable outcome was a dramatic reduction in available rental housing precisely when demand was increasing, which naturally drove prices even higher for the remaining units on the market.

The Real Causes Behind Soaring Rent Prices

The fundamental problem driving Spain’s housing affordability crisis has little to do with landlord greed and everything to do with supply constraints. Spanish cities have implemented extremely restrictive zoning laws and building regulations that make it difficult and expensive to construct new housing units. These regulations limit building heights, mandate specific architectural styles, and create lengthy approval processes that can take years to navigate. The result is a severe shortage of housing stock that simply cannot keep pace with population growth and urbanization trends.

Adding fuel to the fire, Spain’s regulatory environment has made property ownership increasingly burdensome and risky for small landlords. Beyond rent controls, the government has made it extraordinarily difficult to evict non-paying tenants, with legal processes that can drag on for years while landlords continue to pay mortgages and maintenance costs without receiving rental income. These policies have particularly discouraged individual property owners from entering or remaining in the rental market, further reducing the available housing supply. According to research from the Foundation for Economic Education, these combined factors create a perfect storm where increased regulation leads to decreased supply, which inevitably drives prices upward despite the price controls intended to do the opposite.

Free Market Solutions That Actually Work

The solution to Spain’s housing crisis lies not in more government intervention but in removing the barriers that prevent the market from responding to demand. First and foremost, Spanish cities need to liberalize their zoning laws and streamline the building approval process. By allowing taller buildings, mixed-use developments, and faster permitting procedures, cities could unleash a wave of new construction that would naturally increase supply and moderate prices. Studies from urban planning experts consistently show that cities with more flexible zoning regulations have more affordable housing and better respond to population changes.

Equally important is the need to eliminate rent control policies and restore property rights for landlords. When property owners have confidence that they can set market rates, adjust prices as needed, and remove problematic tenants through reasonable legal processes, they are far more likely to invest in rental housing. This increased investment leads to more available units, better maintained properties, and ultimately more competitive pricing as landlords compete for tenants. The evidence from cities that have rejected rent control in favor of supply-side solutions demonstrates that free markets, when allowed to function, provide far better outcomes for both landlords and tenants than government price fixing ever could.

Key Free Market Reforms for Housing Affordability:

- Zoning Reform: Eliminate restrictive height limits and allow mixed-use development

- Streamlined Permitting: Reduce approval times from years to months

- Property Rights Protection: Allow landlords to set market rates and enforce lease agreements

- Reduced Building Regulations: Simplify building codes while maintaining safety standards

- Tax Incentives: Encourage new construction through targeted tax relief rather than price controls

Comparison: Regulated vs. Free Market Approaches

| Aspect | Government Intervention | Free Market Approach |

|---|---|---|

| Supply Response | Decreases as investors exit market | Increases as opportunities attract investment |

| Price Trends | Initially stable, then rapid increases | Gradual stabilization through competition |

| Housing Quality | Deteriorates due to reduced maintenance incentives | Improves through competitive pressure |

| Availability | Severe shortages develop | Expands to meet demand |

| Long-term Sustainability | Creates ongoing crises requiring more intervention | Self-correcting through supply and demand |

In Short

Spain’s housing crisis serves as a powerful reminder that economic laws cannot be repealed by government decree. The country’s experiment with rent control and heavy regulation has produced exactly what economic theory predicted: reduced supply, higher prices, and increased suffering for the very people these policies were meant to help. The path forward requires courage from policymakers to admit these mistakes and embrace market-oriented reforms that address the real problem of insufficient housing supply.

The lessons from Spain extend far beyond its borders. Cities and countries around the world facing similar affordability challenges should take note of what happens when governments attempt to control prices rather than remove barriers to supply. By liberalizing zoning laws, protecting property rights, and allowing markets to function, Spain could transform its housing crisis into a success story. The question is whether political leaders will prioritize effective solutions over policies that sound good but deliver disastrous results.

The evidence is clear: free markets, supported by sensible regulations that protect safety without restricting supply, provide the best path to housing affordability. Spain’s experience demonstrates that the alternative, well-intentioned government intervention in the form of price controls and excessive regulation, leads only to scarcity, higher prices, and reduced quality. Other nations would be wise to learn from Spain’s mistakes rather than repeat them.

FAQ

What caused Spain’s housing crisis?

Spain’s housing crisis resulted primarily from a combination of strict rent control policies, restrictive zoning laws, and regulations that made property ownership burdensome for landlords. These factors reduced the available housing supply while demand continued to grow.

Did rent control work in Spain?

No, rent control in Spain had the opposite of its intended effect. Rather than making housing more affordable, it caused landlords to withdraw properties from the rental market, reducing supply and ultimately driving prices higher for remaining units.

What cities in Spain are most affected by the housing crisis?

Barcelona and Madrid have been particularly hard hit by the housing crisis, experiencing some of the steepest rent increases and most severe shortages of available rental properties.

How can Spain solve its housing affordability problem?

Spain can address its housing crisis by liberalizing zoning laws to allow more construction, eliminating rent control policies, streamlining building permit processes, and protecting property rights to encourage investment in rental housing.

Why do landlords leave the rental market under rent control?

Landlords exit the rental market under rent control because the combination of capped rents, difficulty evicting non-paying tenants, and ongoing maintenance costs makes rental property ownership financially unviable or excessively risky.

Are there examples of cities that solved housing crises without rent control?

Yes, several cities have successfully addressed housing affordability by focusing on increasing supply through zoning reform and streamlined building processes rather than implementing price controls, though specific examples vary by region.

Join The Discussion